5 Online Pharma Trends to Leverage for Sales in 2026

E-commerce to the UK: Navigating Post-Brexit Bureaucracy in 2026

We have now entered the sixth year post-Brexit, and the landscape for Italian businesses selling online to the United Kingdom has finally stabilised. The rules are now clear and established, supported by stringent customs protocols that demand absolute accuracy.

Yet, despite the bureaucratic hurdles, the UK remains a priority destination for "Made in Italy" products. The latest data confirms that those who have successfully adapted to the new regulations are reaping significant rewards. However, accessing this market in 2026 requires a flawless operational structure: you must either internalise the complexity or rely on an outsourced Merchant of Record service.

Why tackle customs complexity? Because British demand for Italian products is steadily increasing. Analysing the macroeconomic picture from the past year (Source: Istat and 2025 Observatories), several unmistakable trends emerge:

Export Growth: As early as the January–August 2025 period, Italian exports to the UK rose by 2.4% year-on-year, positioning Italy as the UK's 6th largest supplier (with a 4.3% market share).

Extra-EU Driver: According to 2025 ISTAT data, the UK is among the fastest-growing extra-EU markets, with an annual increase in Italian sales reaching +10% in value.

Structural E-commerce: Italian e-commerce reached a total value of €85.4 billion in 2024 (+6%). This was driven by cross-border trade, which now accounts for 39% of total online sales (a sharp increase from 28.7% in the pre-pandemic year of 2019).

Italian Presence: Despite logistical challenges, approximately 8% of Italian online stores selling abroad regularly reach customers in the UK—a figure now comparable to historical markets such as Switzerland and the USA.

These statistics demonstrate a concrete potential where the only real barrier is customs complexity.

If your volumes justify the investment, operational management remains the true hurdle. Choosing to sell directly (D2C) means your company must act as a British entity for tax purposes. In 2026, HMRC (the UK tax authority) cross-references data in real-time: shipments without the proper requirements are blocked immediately.

The mandatory checklist for operating independently includes:

UK VAT Registration: Essential for remitting local VAT. Selling to British consumers is not possible without this registration.

GB EORI Number: Distinct from the EU EORI, this is the "passport" for your goods. Without it, shipments will not clear the border.

"Windsor Framework" Procedures: Fully operational since 2025, these distinguish goods destined for Great Britain from those for Northern Ireland. Labelling and declarations must be precise to the millimetre.

Customs Classification (HS Codes): An incorrect code today triggers automatic penalties and delays that compromise brand reputation.

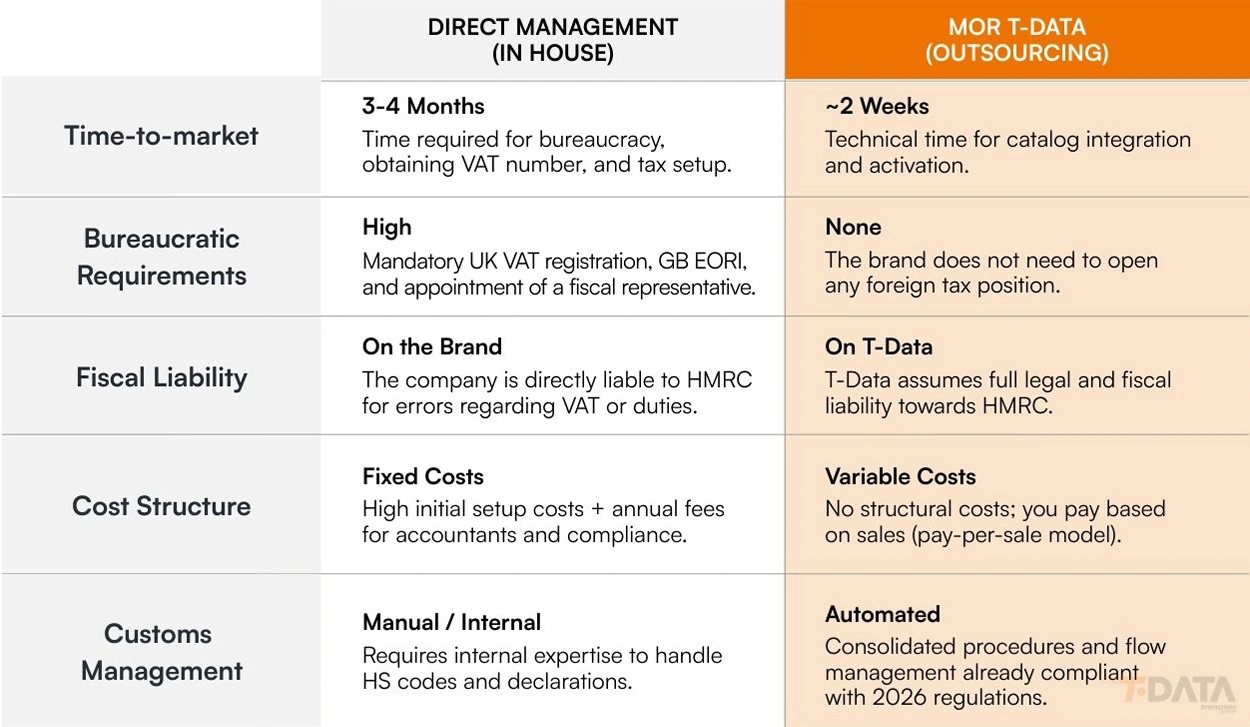

Choosing this route requires budgeting for 3–4 months of bureaucratic setup and fixed costs for local tax consultants.

The fastest way to sell in 2026 is the Merchant of Record model. In this scenario, T-Data acts formally as the local seller, assuming full tax liability for the transaction.

The mechanism is based on the "Flash Title" (instantaneous transfer of ownership), which liberates the brand from bureaucracy:

At the point of order, T-Data technically interposes itself in the sale, appearing as the entity supplying the goods to the final customer.

As the formal seller, T-Data collects the payment, remits VAT to HMRC, and manages all customs formalities.

The brand retains full control over pricing, catalogue, and marketing strategies, while T-Data acts as a shield against regulatory complexity.

T-Data operates with a UK VAT registration that has been active for years and utilizes established customs procedures. There is no need to wait months for authorisations that we already possess.

In 2026, British customers expect the same level of service as a local purchase. Relying on a Merchant of Record allows you to transform UK exports into a seamless process, eliminating customs friction and allowing your brand to focus on the only thing that matters: growing the sales figures that the market is already offering.