Amazon FBA: what it is and how it works. A guide to costs and selling strategy

Purchase frequency, stable margins and gateway brands explain why beauty has become the economic engine of digital luxury

The world of fashion and luxury is experiencing a period of major upheaval: frequent leadership changes, fluctuating financial results, and increasingly unpredictable consumers.

But behind the loudest headlines, something more interesting is happening.

While the big names in fashion are slowing down, beauty is booming. Lipsticks, perfumes and skincare have become the new engine of luxury. More accessible products, purchased more frequently, capable of generating volumes and margins that clothing today struggles to deliver.

Understanding where value is truly shifting means looking beyond the catwalks and quarterly reports. This is where the future of the sector is being shaped, and eCommerce managers must be able to read it to move in the right direction.

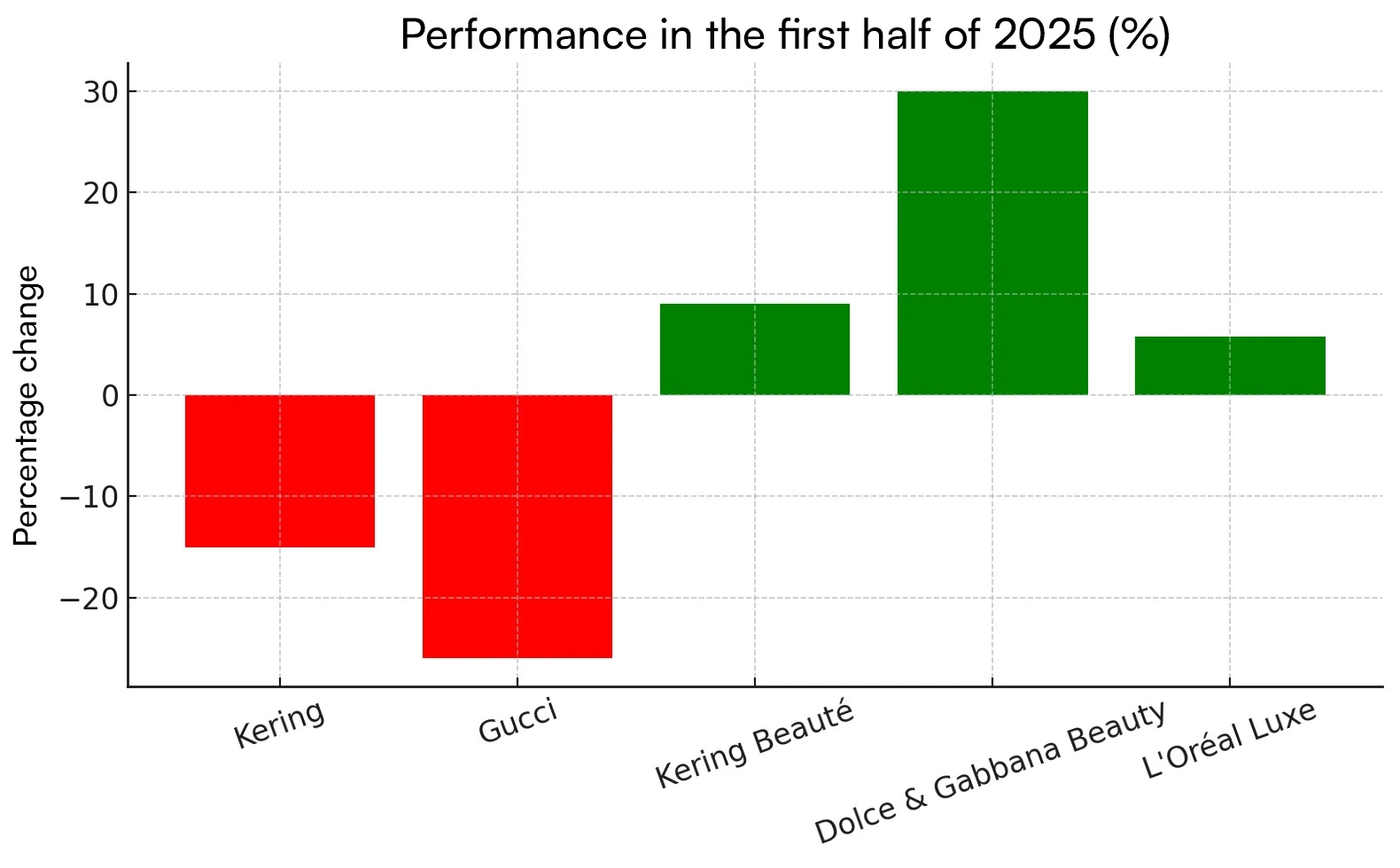

First half of 2025: Kering closes at -15%, with Gucci down -26%. In the same period, Kering Beauté rises by +9%, Dolce & Gabbana Beauty jumps +30%, and L’Oréal Luxe advances by +5.8%.

Exceptions? On the contrary. This is the norm.

Consumers haven’t stopped wanting major brands. They’ve just changed the entry point. A Gucci lipstick costing €45 is true, tangible, immediate luxury. A €2,500 bag requires reflection, saving, sometimes sacrifice. Cosmetics have become the way people “vote” for the brands they love, without waiting for special occasions or company bonuses.

Moreover, a lipstick or perfume is consumed, finished, and repurchased. They have a purchase frequency that a bag simply ignores. They generate customer returns systematically and act as a gateway: consumers enter the brand through beauty, build loyalty, and may eventually move on to more expensive products.

It’s a completely different business model from fashion: stable volumes, attractive margins, planned repurchase. And it’s winning.

For those managing eCommerce in the luxury sector, this scenario presents concrete challenges:

Catalogue management: selling fashion and beauty together means coordinating different logics such as stock rotation, seasonality, cosmetics regulations, and product expiry dates. Flexible platforms and integrated processes are essential.

Marketing strategies and trends: high-margin beauty products require dedicated content and narratives, designed for everyday routines rather than special occasions. Understanding which products attract new customers, act as gateway brands, and generate interest through collaborations or limited editions is crucial.

Omnichannel and logistics: physical stores have become operational hubs for eCommerce. Online orders collected in-store, synchronized stock between physical and digital warehouses, real-time tracking. All of this forms the minimum infrastructure for a truly functional customer experience. Luxury sellers today must manage this complexity or risk losing sales over trivial issues such as product availability or in-store pick-up.

Faced with such complexity, the question every brand should ask is: pursue operational tasks or return to the heart of their work – creating desirable products and telling their story authentically?

This is where T-Data comes in, handling everything that could distract from the core objectives:

Managing hybrid catalogs, coordinating stock rotation, expiry dates, and different seasonal cycles.

Providing marketing teams with clean, structured data to understand which products work and help identify consumption trends.

Building the infrastructure for a working omnichannel experience: online orders collected in-store, real-time tracking, synchronized stock between physical and digital warehouses.

The result? Brands are free to fully focus on creating desirable products and telling their story the right way.

Source: Consorzio Netcomm